The auto insurance industry finds itself at a place where technological innovation meets changing customer expectations. For decades, vehicle inspection methods have remained largely the same, but they’re becoming very inadequate for today’s consumers who expect instant results and seamless digital experiences. Insurers face the growing pressure to cut the costs, improve accuracy, and also deliver better customer service, making real-time vehicle inspection technology a solution that is very important.

Real-time vehicle inspections go beyond simple technological upgrades. They showcase an important change in how the insurance industry looks at the risk assessment and claims processing. This way uses artificial intelligence, computer vision, and mobile technology to deliver fast, accurate vehicle assessments that also benefit insurers, customers, and the broader automotive ecosystem.

The effect of this technology reaches far beyond just its efficiency improvements. Real-time inspections create new business models and build stronger customer relationships.

This examination explores why real-time vehicle inspections are becoming the new standard for AI auto insurance operations. We’ll analyze current challenges, examine technological capabilities, and discuss the substantial benefits driving adoption across the industry.

The ongoing problems with traditional vehicle inspections

Traditional vehicle inspection processes have created persistent inefficiencies that affect both operational costs and customer satisfaction.

Time-consuming and labor-intensive operations

Conventional vehicle inspections demand significant time from multiple people throughout the process. Insurance adjusters schedule appointments, travel to inspection sites, conduct thorough examinations, and complete detailed documentation. This typically takes several hours per vehicle and can stretch across multiple days when scheduling conflicts occur.

Manual inspections create bottlenecks at several points:

● Geographic constraints affect response times in remote locations

● Weather conditions can delay outdoor inspections

● Coordination between insurers, customers, and repair shops becomes complex

● Documentation demands extensive written reports and photographs

These time constraints become particularly challenging during busy claim periods. After natural disasters or during heavy accident seasons, adjuster resources get stretched thin while customer patience wears down.

Unnecessary delays throughout the process

Traditional inspection methods introduce delays at multiple stages throughout the process. Initial inspection scheduling can take days or weeks, depending on adjuster availability and location constraints. The inspection itself requires scheduling between adjusters and vehicle owners, which often leads to many rescheduling attempts.

Additional delays occur during:

● Report compilation and documentation review

● Quality control procedures requiring supervisory approval

● Correction cycles when initial assessments need revision

● Communication gaps between adjusters and claims processing teams

● Administrative processing time for report submission and approval

These accumulated delays significantly extend total claim resolution times, frustrating customers and creating operational inefficiencies that hurt overall business performance.

Report and process inconsistencies

Human-centered inspection processes naturally include variability based on individual adjuster experience, training, and judgment. Different adjusters help to assess identical damage differently, creating rather inconsistent repair estimates and settlement amounts. This creates a lot of problems:

Assessment variations: Individual adjusters study and analyze the damage severity on different bases according to their experience and training. One adjuster might consider damage minor requiring simple repair, while another classifies the same damage as significant requiring extensive restoration.

Documentation quality differences: Inspection report details and quality vary significantly with different adjusters. Some provide in detail documentation with precise photographs and exact measurements. Others produce minimal reports lacking sufficient detail for accurate processing.

Regional and cultural variations: Adjusters in many varied areas may apply varying standards based on local repair costs or cultural expectations. This leads to inconsistent treatment of similar claims across the different markets.

What real-time inspections means

Real-time vehicle inspection technology marks a significant departure from traditional assessment methods. It uses advanced artificial intelligence and mobile technology to deliver instant, accurate vehicle condition reports.

Smartphone and camera technology driving the change

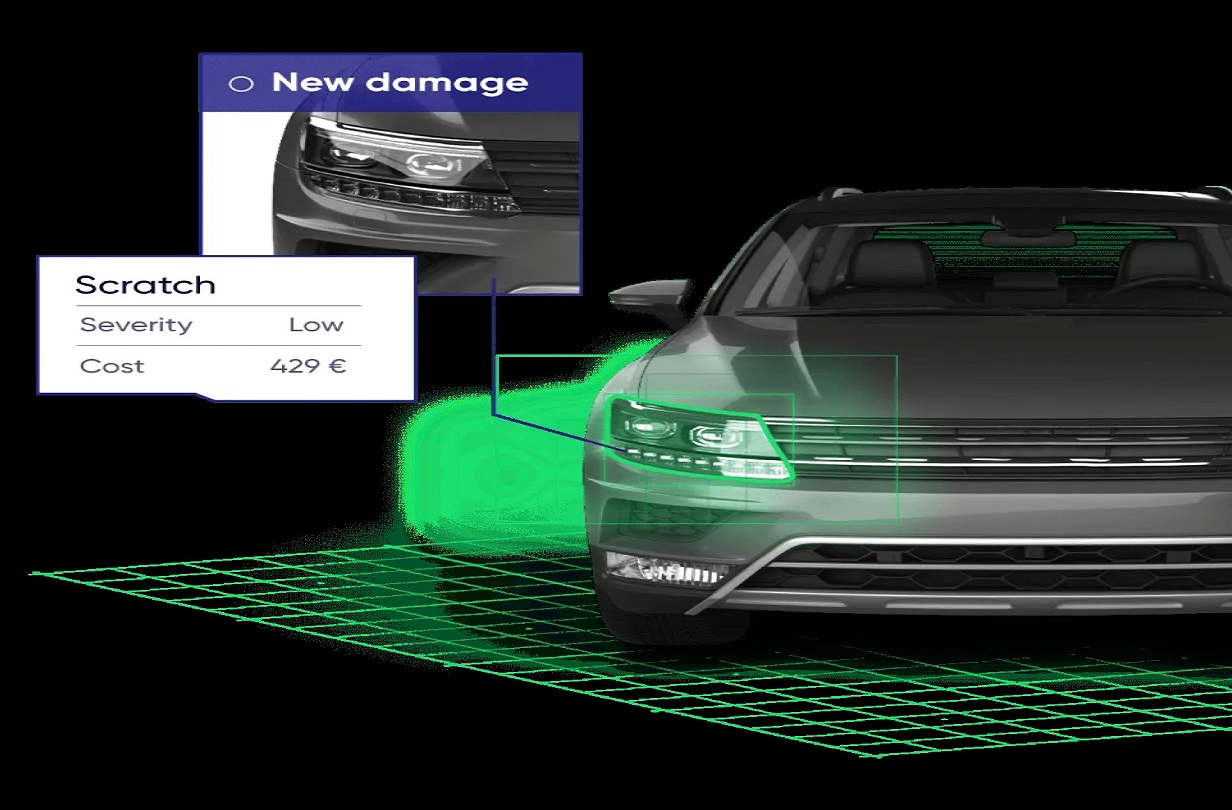

Real-time inspection systems use sophisticated computer vision algorithms trained on extensive datasets of vehicle damage patterns. These systems analyze smartphone photographs or fixed camera images to identify, classify, and assess damage with remarkable accuracy and consistency.

Advanced machine learning models process submitted images within seconds, identifying damage types, assessing severity levels, and generating detailed condition reports. These AI systems continuously learn and improve through exposure to new damage patterns and feedback from repair outcomes.

Real-time systems use cloud computing infrastructure to provide instant processing capabilities regardless of location or device specifications. This ensures consistent performance and eliminates hardware limitations that might otherwise constrain adoption.

Instant processing and detailed reports

AI processes these scans in seconds to generate a detailed vehicle condition report. Real-time inspections transform the customer experience by putting control directly in vehicle owners’ hands.

Customers can initiate inspections immediately after incidents occur, receiving instant feedback about damage severity and estimated repair costs.

Vehicle owners can do inspections anytime, from anywhere, without waiting for adjuster availability. This immediate access reduces the stress and uncertainty during the very challenging situations.

Intuitive mobile applications guide customers through systematic vehicle inspections, ensuring comprehensive coverage while maintaining ease of use.

Within seconds of completing the inspection process, customers receive detailed reports including damage assessments, recommendations on repair, and estimated costs.

Seamless sharing across stakeholders

Reports can be instantly shared with insurers, repair shops, or fleet managers. Real-time inspection systems include existing insurance workflows and also make it possible for having easy sharing across stakeholders. Generated reports can be instantly transmitted to insurers, repair facilities, and fleet managers, creating a connected ecosystem that improves coordination and reduces processing delays.

Reports generated in standardized formats that integrate easily with existing insurance management systems, repair shop software, and fleet management platforms.

Benefits of real-time inspections

Adopting real-time inspection technology delivers substantial benefits across multiple dimensions of insurance operations, from improved customer experience to enhanced operational efficiency and cost reduction.

Faster claims processing

Real-time inspections dramatically reduce the time required for damage assessment and claims initiation. What traditionally required days or weeks can now be completed in minutes, enabling faster claim resolution and improved customer satisfaction.

Customers can conduct inspections immediately following incidents, eliminating delays associated with adjuster scheduling and travel time. This immediate assessment capability enables faster claims initiation and processing.

Standardized AI assessments enable automated approval workflows for straightforward claims, reducing manual review requirements that typically create processing bottlenecks. Complex cases still receive human oversight, but routine claims can be processed automatically.

Real-time damage assessments enable immediate repair authorization for approved claims, allowing customers to begin repairs without waiting for traditional inspection and approval cycles.

Improved customer experience

Real-time inspection technology addresses many pain points that historically frustrated customers during the claims process, creating more positive experiences that improve satisfaction and retention.

Customers appreciate the ability to initiate inspections on their schedule, without coordinating with adjuster availability or waiting for appointment slots. This control over the process reduces stress and improves overall satisfaction.

Self-service inspection capabilities reduce the inconvenience to customers’ daily routines, removing the need to wait for adjusters or arrange time off work for inspection appointments.

Reduced operational costs

Real-time inspection technology delivers substantial cost savings across multiple operational areas, improving profitability while maintaining or enhancing service quality.

Automated inspections significantly reduce human resources required for damage assessment, enabling insurers to reallocate adjuster time to more complex cases that need human expertise.

Eliminating the need for physical inspections reduces travel costs, vehicle expenses, and administrative overhead associated with scheduling and coordination activities.

Automated processing of routine claims allows human adjusters to focus on complex cases that provide greater value, improving overall resource utilization and productivity.

Standardized AI assessments minimize errors and inconsistencies that traditionally require costly correction cycles and re-work processes.

Enhanced fraud detection

Real-time inspection systems incorporate sophisticated fraud detection mechanisms that identify suspicious patterns and inconsistencies more effectively than traditional human-based assessments.

AI systems can identify subtle patterns and anomalies that might indicate fraudulent activity, such as inconsistent damage patterns, suspicious timing, or irregularities in submitted documentation.

Real-time systems can instantly cross-reference submitted claims against databases of known fraud patterns, previous claims history, and external data sources to identify potential red flags.

Advanced algorithms can detect signs of image manipulation or staged damage, helping insurers identify fraudulent claims before processing occurs.

Machine learning models continuously improve their fraud detection capabilities by learning from new patterns and feedback, becoming more effective over time.

Pre-policy underwriting and risk assessment

Real-time inspection technology enables new opportunities for risk assessment and underwriting that were previously impractical or impossible with traditional methods.

Real-time inspections can be used at the point of onboarding. Insurers can conduct comprehensive vehicle inspections at the point of policy application, providing accurate risk assessment data that improves underwriting accuracy and pricing precision.

This helps identify pre-existing damage before issuing a policy. Real-time inspections help identify pre-existing damage before issuing a policy, reducing claim disputes and improving underwriting accuracy by establishing clear baselines for vehicle condition.

Regular inspection capabilities enable ongoing risk assessment throughout the policy period, allowing insurers to adjust coverage or pricing based on changing vehicle conditions.

Better data for continuous improvement

AI inspections generate structured data that eliminates variability and inconsistencies associated with human-generated reports. This standardization enables more effective analysis and trend identification.

Large-scale data collection enables sophisticated analytics that identify risk patterns, predict claim likelihood, and operational processes. These insights help to make continuous improvement in products, pricing, and operations.

Structured inspection data feeds predictive analytics models that forecast future claim likelihood, enabling proactive risk management and prevention strategies that benefit both insurers and customers.

Real-world use cases and adoption

The practical implementation of real-time vehicle inspection technology across the insurance industry demonstrates its transformative potential and validates the benefits outlined in theoretical discussions.

Leading insurtechs and traditional insurers

Leading insurtechs and traditional insurers are piloting or adopting this technology as a competitive differentiator and customer acquisition tool. These innovative companies demonstrate how technology can create entirely new business models and customer experiences.

Insurtech companies build their entire customer experience around real-time inspection capabilities, creating seamless digital journeys that appeal to tech-savvy consumers who expect instant, convenient services.

Real-time inspection technology enables insurtech companies to scale operations rapidly without proportional increases in human resources, supporting aggressive growth strategies and market expansion.

The superior customer experience delivered by real-time inspections becomes a significant competitive advantage in customer acquisition and retention efforts.

Established insurance companies are increasingly including real-time inspection technology as part of digital transformation. These inclusions show how traditional insurers can make operations evolve while leveraging existing infrastructure and customer relationships.

Many traditional insurers implement real-time inspections alongside existing processes, allowing gradual transition and staff adaptation while maintaining service continuity.

Successful implementations show how real-time inspection technology can integrate with existing insurance management systems and workflows without requiring complete system overhauls.

Faster claim approvals and reduced inspection turnaround time

Case studies from early adopters show substantial improvements in key performance metrics following real-time inspection implementation.

Case studies show faster claim approvals and reduced inspection turnaround time. Organizations report inspection turnaround time reductions from days or weeks to minutes, dramatically improving customer satisfaction and operational efficiency.

End-to-end claims processing times show significant improvement, with some routine claims being resolved in hours rather than days or weeks.

Documented cost savings include reduced labor expenses, lower administrative overhead, and decreased fraud losses resulting from improved detection capabilities.

Market demand for contactless and tech-driven experiences is rising

Market demand for contactless and tech-driven experiences is rising, accelerating the adoption of real-time inspection technology across the insurance industry.

The COVID-19 pandemic accelerated demand for contactless service options, making real-time inspections not just convenient but essential for maintaining business continuity.

Modern consumers, particularly younger demographics, expect instant, digital-first experiences across all service categories, including insurance.

As early adopters demonstrate superior customer experiences and operational efficiency, competitive pressure drives broader industry adoption of real-time inspection technology.

Implementation considerations and future outlook

While real-time vehicle inspection technology offers substantial benefits, successful implementation requires careful consideration of technical, operational, and strategic factors.

Successful real-time inspection deployment requires robust technical infrastructure, including cloud computing capabilities, mobile application development, and AI model training and maintenance. Organizations must invest in technology platforms that can scale with growing demand while maintaining performance and reliability standards.

The change from the traditional to real-time inspection processes needs extensive change management strategies that help to address staff training, workflow modifications, and cultural adaptation. Organizations must prepare their workforce for new roles and responsibilities while maintaining service quality during the transition period.

Successful implementation depends on customer adoption and proper usage of real-time inspection tools. Organizations must invest in customer education programs and support systems that ensure customers can effectively utilize new capabilities.

Conclusion

Real-time vehicle inspections showcase an important transformation in how the auto insurance industry, just like Inspektlabs, approaches damage assessment, claims processing, and even customer service. The technology helps to solve the challenges in traditional inspection methods while also delivering huge benefits across operational efficiency, customer satisfaction, and even cost management.

As market demand for digital, contactless services continues to grow, real-time inspection capabilities will become essential for competitive success in the evolving insurance landscape.

Organizations that embrace this technology early will gain significant advantages in customer acquisition, operational efficiency, and cost management.

The future of auto insurance includes the intelligent, automated, and customer-centric approaches that leverage technology to deliver value for all stakeholders. Real-time vehicle inspections are not just the future of auto insurance—they are rapidly becoming the present standard for forward-thinking organizations committed to excellence in customer service and operational efficiency.