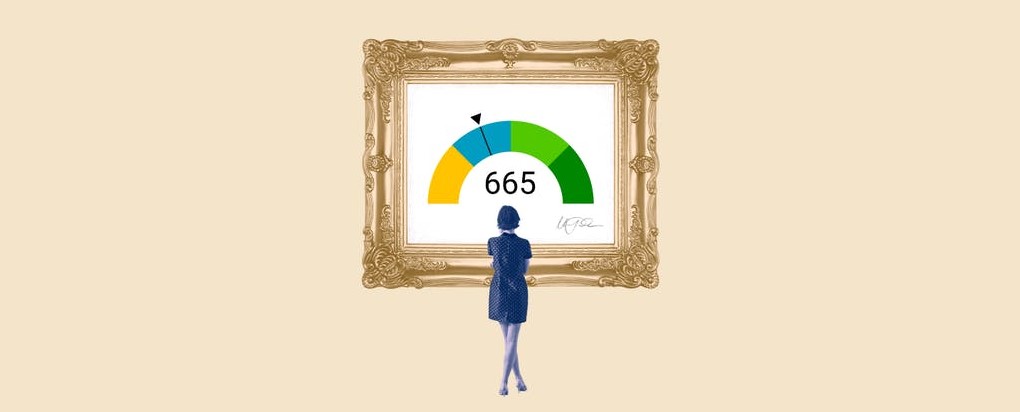

665 Credit Score – Is It Good Or Bad?

A FICO rating of 665 is thought of as “fair” credit. It’s something nice to do, and it ought to end there. Both will probably be endorsed, and average APR and terms will frequently be advertised.

665 is viewed as a decent FICO rating for a vehicle credit! The higher your FICO assessment, the lower your possibility of getting endorsed with lower loan costs. Most banks prescribe a FICO rating over 661 to get the best rate.

Since your FICO assessment falls into the cost range, you ought to have no issue. To ensure you get the best credit offer, look around and gather costs from something like three distinct moneylenders.

If you have any desire to build your FICO assessment to meet all requirements for a superior loan cost, attempt these tips:

• Pass up no installments.

• Make a credit record utilizing the significant credit departments to open new documents.

• Limit the number of new records you open.

• Keep your Mastercard balance low.

Is 665 a decent FICO rating?

The 665 FICO® scores are thought of as “fair.” Mortgages, cars, and individual credits are rare with a 665 FICO rating. Banks ordinarily don’t work with loan specialists who have sufficient credit since it is exceptionally hazardous.

Uplifting news?

Fixing your credit is one of the most amazing ways of fixing your score, and opening the blissful way of life that you and your family merit.

A FICO rating of 665 methods:

- FICO assessment: Fair

- Advance Options: Limited

- The expense of the advance: extravagant

- Most ideal Option: Credit Repair

Provided that this is true, further develop your financial assessments.

Likewise, your score of 665 is exceptionally near a decent FICO rating of 670-739. With some work, you can reach (and even surpass) this score, and that implies more admittance to credit and advances at better loan fees.

The most ideal way to further develop your FICO rating is to begin by checking your FICO® score. The report submitted with the score will utilize the subtleties of your special credit report so you can propose ways of expanding your score. Assuming you center around the issues portrayed in the report and take on propensities that advance great FICO assessments, you can see enduring improvement in scores and more extensive admittance to credit that frequently goes with them.

Blue-normal financial assessments influence your funds

Albeit 665 is near being viewed as a decent FICO rating by both significant scoring models, you might in any case need to pay something else for credits and different sorts of credit. This is because your loan specialist might charge you a higher financing cost on the off chance that they don’t think of you as a significant borrower somebody who is generally safe from default.

Revamp your 665 FICO rating

Acknowledge fix organizations, for example, Credit Glory:

- Assess Your Credit Report – Drag your credit report and recognize every one of the negative, hurtful things that are smothering your 665 scores.

- Negative Dispute Items – Customize and send Conflict Letters to the Bureau mentioning that these negative things be taken out from your report (for good).

- Eliminate Harmful Items – Repair administrations, for example, Credit Glory will keep on questioning the things for your sake except if they further harm your standing.

Credit card options

Visa Options If your FICO financial assessment falls between a fair scope of 650 to 700, then, at that point, you have somewhat normal credit. Albeit monetary organizations won’t give you the best cards, you can in any case find extraordinary loan fees and terms with next to no problem. Dissimilar to individuals with low financial assessments, you may really be qualified for terms that outcome in no yearly expenses. What’s more, when you pay routinely, you will begin meeting all requirements for better cards.

Yet, how would you let me know if your credit is great? It’s somewhat confounded. First of all, you don’t simply have a FICO rating. Almost certainly, you have a wide range of FICO ratings that have been created utilizing various credit scoring models.

Most licensed FICO assessments, for example, those created by FICO and VantageScore, commonly range from 300 to 850. In any case, a few scores utilize various reaches. Credit scoring models depend on various elements to ascertain your scores, producing credit report information from three significant buyer credit departments.

What is their credit score?

A FICO rating estimates that you are so liable to reimburse a credit on time. The scoring model purposes data from your credit report to make a FICO rating. Organizations utilize a numerical equation to fabricate your FICO rating from the data in your credit report – called a scoring model.

Installment date

Invalid records and late or missed installments can harm your FICO rating. Convenient installment of your bills will assist your credit with scoring. It’s extremely clear, and it’s the single greatest effect on your FICO assessment, which depends on 35% of your FICO® score.

Ongoing applications

At the point when you apply for a credit or charge card, you start a cycle considered a troublesome request, in which the bank requests your FICO rating (and frequently your acknowledge report too). ۔ A thorough request ordinarily meaningfully affects your FICO rating. However long you keep on paying on time, your FICO rating will generally recuperate rapidly from the impacts of extreme inquiries. (Checking your credit is a delicate request and affects your FICO rating.) Recent credit applications can contribute up to 10% to your FICO® score.

Bring down your credit chart book rates

Your credit utilization rate is the level of the accessible credit that you are utilizing. For instance, if you have a charge card with a restriction of $ 1,000 and you owe $ 500, you have a credit use pace of half.

As a general rule, the lower your credit usage rate, the better your scores. A decent guideline is to keep your credit utilization rate beneath 30% – and even lower if conceivable. The half rate is an illustration of a high pace of credit use that can adversely influence your credit.

You can diminish your credit usage rate by taking care of obligations (and not charging more than your ongoing Mastercard).

Pay on time

Showing banks that you can make customary installments on time is a significant piece of your credit profile. Center around ideal installments with your current credit lines to make a positive installment history.

On the off chance that you as of now have late installments or records on your credit reports, they will as a rule fall following seven years. On the off chance that it has been over seven years, or on the other hand assuming you have paid on time and the late installment on your reports is inaccurate, you can eliminate the late installment from your credit reports.